NYSE Enables Easy Access to API Products with Kong

World’s largest stock exchange uses Kong to provide a scalable way to safely expose data externally

The New York Stock Exchange (NYSE) is an American stock exchange founded over 200 years ago and headquartered in New York City. It is the largest stock exchange in the world by market capitalization, and is part of the Intercontintental Exchange Group (ICE).

Creating a scalable, API-first way to make data available

The New York Stock Exchange (NYSE) operates five equities and two option exchanges, with over 11,000 equities and ETFs and over 1.6 million options. This means that on an average day, they’ll process over 2.5 billion shares and more than 600 billion messages, with the number reaaching 1.2 trillion on peak volume days. In order to make this massive amount of data available to customers, they turned to APIs.

At API Summit 2025, Edward Keymakh, Director of Development, shared how the team at NYSE evolved from web products to API products, and where they are looking to go next.

Complex infrastructure adds requirements

Early on in their journey to make data accessible to customers, NYSE focused on building modern web experiences. “When we set out to build modern web experiences years ago, our market participants needed a way to come to our websites and access their data in a meaningful way. Those rich web experiences were what we focused on,” says Keymakh. However, they discovered that web applications had limitations that kept them from being a scalable solution. They required constant redesigns, user retraining with each interface change, and couldn't easily accommodate the diverse needs of customers operating across all seven exchanges. Different customers needed different workflows, and the prescriptive nature of web interfaces couldn't provide the flexibility and agility their market participants required.

The team then turned to APIs to give their customers the versatility they needed. The initially built their own API platform, an attitude that Keymakh commends. “That is the attitude you want from your development team, right? Smart engineers coming together, looking at each other and saying, "Of course we can, right?" That's the attitude of good engineers. They want to innovate. They want to develop and have something they're proud of.”

As they were building, though, they realized that building an API infrastructure came with a great deal of complexity. It meant dealing with configurations, routing rules, and traffic policies across multiple teams, which slowed time to market. The result wasn't scalable, repeatable, or something others in the organization could easily adopt. They realized they needed a better solution.

“It's very difficult to be prescriptive to tell customers how they should access their data when they participate in all seven exchanges. APIs give them versatility. They can do whatever works best and will help drive their business forward faster.”

Launching a scalable, secure API management platform

Keymakh and the team at NYSE decided to move from their homegrown platform to Kong. “Because we have done it ourselves, it is so much easier to appreciate a good product because you have something to compare it to. I think that goes with anything in life. Once you go through some hardships and you see a mature product, you go, ‘Ah, this makes things so much easier’,” said Keymakh. Some of the features built into their Kong platform include:

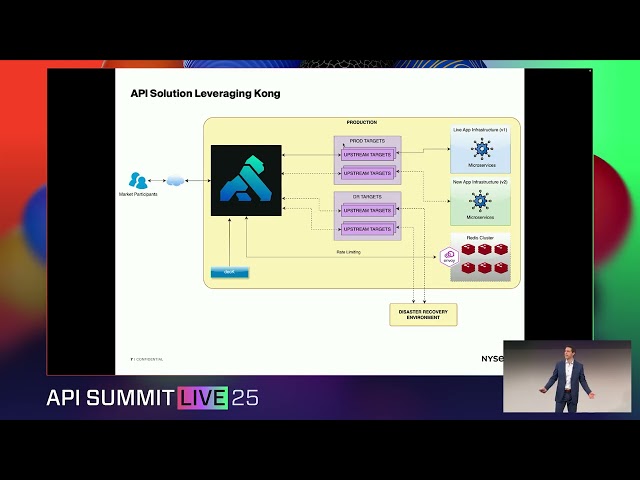

Infrastructure Management: They defined upstreams connecting to both legacy and new infrastructure across production and disaster recovery environments, ensuring fault tolerance and high availability during their infrastructure modernization.

Rate Limiting: The NYSE team used Redis for rate limiting, with Kong's team collaborating to enhance the rate limiting plugin to work with Envoy for connecting to Redis clusters.

GitOps with decK: They adopted decK for configuration management, establishing a single source of truth in git with versioning and auditing capabilities. They created reusable components and partials that teams could leverage across multiple workspaces. "decK allowed us to take a GitOps approach to configuration and make sure all of our teams that are going to utilize the API infrastructure have a one-stop shop and one source of truth,” said Keymakh.

AI Acceleration: The team has also incorporated AI tooling into their API development cycle to generate 95-98% of configuration automatically based on documented standards and naming conventions. This not only accelerates the development cycle, but also helps ensure consistency in API configuration.

"We are investing in an API-first approach. What that means is setting up our future to enable our customers to execute their important business functions and workflows in the way that suits them. And Kong is a huge part of making that happen.”

APIs as the foundation for the agentic era

The Kong implementation enabled NYSE to make the transition to their modernized infrastructure completely seamless, allowing customers to access APIs securely and efficiently without disruptions while routing between legacy and new systems. They’ve also achieved their goal of creating an API infrastructure that serves as a one-stop shop and single source of truth. This accelerates development cycles, increases component reuse to drive efficiency, and has created a way to allow their customers to access data however makes most sense for them.

Looking Forward

NYSE is preparing for the agentic future and focusing on making their APIs AI ready. There are three ways they’re focused on doing this:

Developer Portals: Creating smart, conversational interfaces that help customers quickly find relevant APIs and generate code examples without needing to navigate complex documentation.

Customer Insights: Using data about API usage patterns to proactively suggest complementary APIs and enhance customer workflows.

Semantic API Intelligence: Adding rich metadata to APIs that explains not just how to use them, but when and why—enabling autonomous agents and workflows like personal finance assistants that can execute trades based on individual goals.

Keymakh emphasizes they're adopting an "API-first" approach rather than abandoning web development, providing customers with choice and flexibility. They view APIs as the foundation for the agentic AI era, embodying the exchange's core purpose: connecting people, ideas, and systems through structured interactions.